knowyourbusiness.co.uk is an independent comparison and information service that aims to provide you with the tools you need to make better decisions and our website is a free service to our users.

Whilst we are independent, we receive compensation from our partners for placement of their products or services on our website. We may also receive compensation if you click on certain links posted on our site. Partner arrangements may affect the order, position or placement of product information, but it doesn’t influence our assessment of those products.

knowyourbusiness.co.uk brings you this service without advice or recommendation. Choose products based on your businesses individual requirements. Whilst we aim to bring you a broad range of products, which we continually add more to, other options will be available that are not included on our website.

We regularly check our website to ensure you are viewing up-to-date product information. Whilst we make every effort to ensure that our information is accurate, it is not guaranteed. Always check product details with the brand or service that you’re interested in before making a decision.

- A buildable POS solution making it great for start ups & established business

- All types of payment methods to support every unique business

- No hidden fees, no long term contracts, just pay when you use

- Hardware from just £19*

Eposnow POS

Eposnow POS[card-readers-product-image]

- Monthly Fee:Quote based

- Transaction Fee:Quote based

- Hardware Upfront Cost:From £149*

- Custom quotes and price matching

- Mobile to till POS hardware options supporting large inventories or complex set ups

- Small, Medium and Enterprise business POS solutions

- Summary:Details Here

Payment Solution: Point of Sale (POS or ePOS)

Plan Options: Quote based

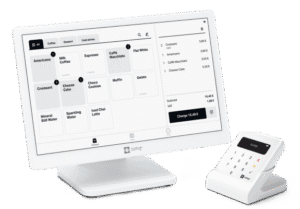

[card-readers-product-image]

-

Monthly Fee:From Free

-

Transaction Fee:From 1.75%

-

Hardware Upfront Cost:From £19*

- A buildable POS solution making it great for start ups & established business

- All types of payment methods to support every unique business

- No hidden fees, no long term contracts, just pay when you use

-

Summary:Transaction Costs: 1.75% for contactless or chip and pin. 1.4% + 25p for online transactions (UK cards) or 1.5 + 25p (non-UK cards) Payment Solution: Point of Sale (POS or ePOS), Custom rates available over £200k per year in sales. Key Features: Real-time analytics, sales, trends, team rotas, inventory, stock levels, loyalty programmes and gift cards. Plan Options: Free POS software, no contract. Additional services, add on's & hardware are chargeable. Charges apply

Payment Solution: Point of Sale (POS or ePOS)

Plan Options: Free POS software, no contract. Additional services, add on's & hardware available, charges apply

[card-readers-product-image]

-

Monthly Fee:From Free

-

Transaction Fee:From 1.69%

-

Hardware Upfront Cost:From £19

- Scale your POS solution to your business from hardware to software features.

- Free up staff, reduce queues and sell more with Sum Up Kiosk

- Simple set up and options for cost conscience small and micro businesses

-

Summary:

Payment Solution: Point of Sale (POS or ePOS)

Plan Options: Free POS, POS Plus £19 per month and POS Pro for £49 per month

We aim to keep all product information in our comparisons accurate and up to date, but details may have changed since publication. Always check before proceeding.

An Introduction to POS or EPOS Systems

Let’s start by clearing up the terminology. Point of Sale (POS) or Electronic Point of Sale (ePOS) mean the same thing. POS has generally superseded ePOS, but you’ll find them used interchangeably. POS has become much more than a modern cash till. For UK businesses, particularly small to medium-sized ones, it’s now a comprehensive system for managing sales, inventory and customer data. Unlike a traditional cash register that simply records transactions and provides a receipt, an POS system acts as a central hub for your entire business operation. It is a combination of hardware (like a terminal, card reader and receipt printer) and software that helps you process payments, track sales and gain valuable insights into how your business is performing.

The shift from cash based payments to cards and digital wallets has been significant in the UK, making a robust payment system an even more essential part of business. An POS handles transactions securely but also automates many manual tasks that once took away a business owner’s time, such as stock taking and financial reporting. For larger businesses, an POS system offers scalability and the ability to manage multiple locations from a single dashboard, while for a small business it provides a level of professional oversight and efficiency that can help them grow.

The Components of a Modern POS System

A complete POS system is made up of various elements that work together to create a streamlined operation.

Hardware

The hardware is the physical equipment you interact with.

- POS Terminal: This is the main unit, often a touchscreen tablet or a dedicated terminal where sales are processed and orders are placed. It’s the central interface for the user.

- Card Reader: This is the device that accepts card payments, including contactless, chip and PIN and digital wallets like Apple Pay. Many modern POS systems have card readers fully integrated, which helps to speed up the checkout process.

- Barcode Scanner: A scanner looks up product prices and details which reduces the chance of human error and makes the checkout process much faster.

- Receipt Printer: A printer generates physical receipts for customers.

- Cash Drawer: For businesses that still handle an element of cash, a cash drawer is also connected to the system, ensuring all types of payment can be taken.

Software

The software is the intelligence behind the system. Most current POS software is cloud based, which means data is stored securely online and can be accessed from anywhere with an internet connection. This is particularly useful for business owners who want to check on sales or manage stock when they’re not on site. The software is what enables the system to do far more than just process sales, offering features like inventory tracking, customer management and in depth reporting.

Key Features and Benefits for Businesses

The true value of an POS system lies in its ability to provide features that go beyond a simple transaction.

Inventory Management

An EOS system provides real-time stock tracking. Every time a product is sold, the system automatically updates the stock count, so you always know what you have on hand and what you need to reorder. It can also be set up to send low-stock alerts helping to prevent you from running out of popular items. This level of oversight helps to reduce waste and improve cash flow.

Reporting and Analytics

An POS system provides detailed reports that give you a clear view of your business’s performance. You can see which products are selling well, identify peak trading times and track sales trends. This data helps business owners to make informed decisions about pricing, staffing and marketing strategies. Cloud based systems allow you to access this information remotely, giving you control even when you’re away from the premises.

Customer Management

Many POS systems include features for securely managing customer data, which can be a valuable asset for marketing. You can capture customer details at the point of sale and use this information to create loyalty schemes or targeted promotions. This helps to build a database of returning customers and encourages repeat business.

Integrations with Other Business Tools

An advantage of POS systems is their ability to integrate with other software that you may already be using. This includes accounting software like Xero or QuickBooks, e-commerce platforms like Shopify and even staff management tools. This level of integration streamlines your operations, eliminates the need for manual data entry between systems and provides a unified view of your business. For a business with both a physical shop and an online store, this is particularly useful as it ensures that your stock levels are always consistent across both channels.

Choosing the Right System

When you’re looking for an POS system, consider your specific business needs. The size and nature of your business will influence your choice.

- Cost: Look at the total cost of ownership, including the initial hardware purchase and any ongoing monthly fees. Some systems are more affordable upfront but may have higher transaction fees, while others have a higher initial cost but lower fees in the long run.

- Flexibility and Scalability: A good system should be able to grow with you. This means being able to add more terminals or locations as your business expands without a complex overhaul. Cloud-based systems are usually well suited to this kind of scalability.

- User Friendliness: The system’s interface should be intuitive and easy for your staff to learn and use. A user-friendly system can help to reduce human error and speed up transactions.

Support: Check what kind of technical support is offered by the provider. Knowing that help is available when you need it can provide peace of mind and prevent costly downtime.

POS SYSTEM FAQs

What is the difference between an POS system and a traditional till?

A traditional till is a basic machine for calculating and recording sales. An POS system is a comprehensive management tool that combines a till with features like real-time stock tracking, detailed reporting and customer management capabilities.

Do I need an internet connection for my POS system?

Most POS systems are cloud-based and require an internet connection to operate. However, many also have an offline mode that allows you to continue processing sales, if your internet goes down. Once the connection is restored the system will sync all the transactions back to the cloud.

How does an POS system help with stock management?

An POS system automatically updates your stock levels every time a sale is made. This gives you a live overview of your inventory, helps you identify which products are selling fastest and can trigger alerts to remind you to reorder items that are running low.

Can an POS system help me with my accounting?

Yes, many POS systems can integrate directly with popular accounting software like Xero or QuickBooks. This means that your daily sales data is automatically transferred, reducing the need for manual data entry and helping you keep your financial records up-to-date and accurate.

Are POS systems secure?

POS systems use robust security measures, including encryption and tokenisation to protect sensitive cardholder data. They are designed to meet industry security and data standards, which helps to protect both your business and your customers’ information from fraud and data breaches.