knowyourbusiness.co.uk is an independent comparison and information service that aims to provide you with the tools you need to make better decisions and our website is a free service to our users.

Whilst we are independent, we receive compensation from our partners for placement of their products or services on our website. We may also receive compensation if you click on certain links posted on our site. Partner arrangements may affect the order, position or placement of product information, but it doesn’t influence our assessment of those products.

knowyourbusiness.co.uk brings you this service without advice or recommendation. Choose products based on your businesses individual requirements. Whilst we aim to bring you a broad range of products, which we continually add more to, other options will be available that are not included on our website.

We regularly check our website to ensure you are viewing up-to-date product information. Whilst we make every effort to ensure that our information is accurate, it is not guaranteed. Always check product details with the brand or service that you’re interested in before making a decision.

- Up to 85% off Tide Card Readers!

- Get a Tide Card Reader for £19.99 and/or a Tide Card Plus for £29.99 within 7 days of opening your Tide Account

- Talk to an agent today

- Hardware Cost:£19 + VAT

- Hardware Monthly Cost:£0

- Transaction Fees:0.79% + 3p within the subscription

- Payout Settlement:1-3 days

- Portable and compact card reader for payments on the go. Monitor sales via the Tide App

- Get a Tide Card Reader for £19.99 within 7 days of opening your Tide Account and subscribing to Sell In-Person (buy device)

- If you process over £8,300 in payments each month book a call with Tide to discuss custom pricing or switching contracts.

- Battery Life:1 day

- Payment Methods:Contactless, Chip + Pin, Digital wallets

- Connectivity:Cellular 4G & Wi-Fi

- Transaction Cost:Ongoing costs: Pay As You Go: 1.39% + 5p per transaction or Subscription: 0.79% + 3p per transaction. Rates for in-person payments on domestic consumer debit cards.

- Warranty:12 months

- Receipt Type:Digital

Payment Methods: Contactless, Chip + Pin, Digital wallets

Connectivity: Cellular 4G & Wi-Fi

Warranty: 12 months

Receipt Type: Digital

-

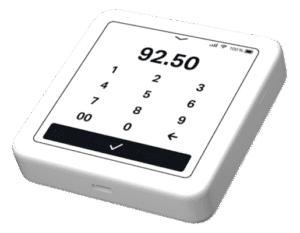

Hardware Cost:£29.99 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:0.79% + 3p within the subscription

-

Payout Settlement:1-3 days

- Reader Plus provides paper and email receipts with a larger touch display

- Get a Tide Card Reader for £19.99 and/or a Tide Card Plus for £29.99 within 7 days of opening your Tide Account and subscribing to Sell In-Person (buy device)

- If you process over £8,300 in payments each month book a call with Tide to discuss custom pricing or switching contracts.

-

Battery Life:1 day

-

Payment Methods:Contactless, Chip + Pin, Digital wallets

-

Connectivity:Cellular 4G & Wi-Fi

-

Transaction Cost:Ongoing costs: Pay As You Go: 1.39% + 5p per transaction or Subscription: 0.69% + 3p per transaction. Rates for in-person payments on domestic consumer debit cards.

-

Warranty:12 months

-

Receipt Type:Paper

Payment Methods: Contactless, Chip + Pin, Digital wallets

Connectivity: Cellular 4G & Wi-Fi

Warranty: 12 months

Receipt Type: Paper

-

Hardware Cost:£0

-

Hardware Monthly Cost:N/A

-

Transaction Fees:1.39% + 5p

-

Payout Settlement:1-3 days

- Get started immediately with contactless payments and no additional hardware

- Accept contactless payments using your iPhone and the Tide app.

- If you process over £8,300 in payments each month book a call with Tide to discuss custom pricing or switching contracts.

-

Battery Life:N/A

-

Payment Methods:Contactless

-

Connectivity:Cellular 4G & Wi-Fi

-

Transaction Cost:Ongoing costs: Pay As You Go: 1.39% + 5p per transaction

-

Warranty:N/A

-

Receipt Type:Digital

Payment Methods: Contactless

Connectivity: Cellular 4G & Wi-Fi

Warranty: N/A

Receipt Type: Digital

Eposnow Payments Lite

Eposnow Payments Lite

-

Hardware Cost:£179 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.50%

-

Payout Settlement:1 day

- 6 months free insurance

- Next-day payment, included for free

- No POS system required

- Instant receipt printing

-

Battery Life:1 day

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:1.50% Rate applies to all card types and pay by link transactions. 12 month contract applies.

-

Warranty:1 year

-

Receipt Type:Digital + Paper

Payment Methods: Contactless, Chip and Pin

Connectivity: SIM & Wi-Fi

Warranty: 1 year

Receipt Type: Digital + Paper

-

Hardware Cost:£19 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.75%

-

Payout Settlement:1-2 days

- Businesses on the go, such as market stalls, mobile services, or freelancers who need a simple and cheap way to accept card payments.

- No monthly fees or long-term commitments.

- Square Reader supports all Square point-of-sale solutions.

-

Battery Life:1 day

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:SIM & Wi-Fi (offline payments for 24 hours)

-

Transaction Cost:1.75% Rate for in person payments on all card types. 1.4% (UK cards) or 2.5% (non UK cards) + 25p for online payment products. 2.5% for manually keyed payments.

-

Warranty:2 years

-

Receipt Type:Digital

Payment Methods: Contactless, Chip and Pin

Connectivity: SIM & Wi-Fi (offline payments for 24 hours)

Warranty: 2 years

Receipt Type: Digital

-

Hardware Cost:£169 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.75%

-

Payout Settlement:1-2 days

- Designed for businesses that need to take orders and payments on the go, such as restaurants, retailers, and service providers.

- Scan products. Add items to basket. Update inventory. Accept QR codes. All in seconds with a built-in scanner.

- Large responsive touchscreen, built-in card slot and intuitive software.

-

Battery Life:1 day

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:SIM & Wi-Fi (offline payments for 24 hours)

-

Transaction Cost:1.75% Rate for in person payments on all card types. 1.4% (UK cards) or 2.5% (non UK cards) + 25p for online payment products. 2.5% for manually keyed payments.

-

Warranty:2 years

-

Receipt Type:Digital

Payment Methods: Contactless, Chip and Pin

Connectivity: SIM & Wi-Fi (offline payments for 24 hours)

Warranty: 2 years

Receipt Type: Digital

-

Hardware Cost:£149 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.75%

-

Payout Settlement:1-2 days

- Businesses that need a professional, all-in-one device for worktop use or for taking payments at the table, such as

cafés,restaurants, or salons.

Single device with touchscreen and an integrated receipt printer.

- Square has a variety of POS options to best support you and your unique business needs.

-

Battery Life:1 day

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:Wi-Fi (offline payments for 24 hours)

-

Transaction Cost:1.75% Rate for in person payments on all card types. 1.4% (UK cards) or 2.5% (non UK cards) + 25p for online payment products. 2.5% for manually keyed payments.

-

Warranty:2 years

-

Receipt Type:Digital & Paper

Payment Methods: Contactless, Chip and Pin

Connectivity: Wi-Fi (offline payments for 24 hours)

Warranty: 2 years

Receipt Type: Digital & Paper

-

Hardware Cost:£19 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.69%

-

Payout Settlement:1 day

- Simple and smart solution for businesses that are on the go.

- For businesses just starting or have a lower volume of transactions

- A palm sized, phone-paired card reader with 500 transactions on one single charge

-

Battery Life:12 hours

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:Bluetooth

-

Transaction Cost:1.69% per in-person transaction for most major credit and debit cards

-

Warranty:12 months

-

Receipt Type:Digital

Payment Methods: Contactless, Chip and Pin

Connectivity: Bluetooth

Warranty: 12 months

Receipt Type: Digital

-

Hardware Cost:£79 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.69%

-

Payout Settlement:1 day

- For businesses that need a more professional mobile, standalone solution with features such as smart tipping and reporting

- Optional palm sized printer, which doubles as a battery pack for the Solo.

- Free, built-in SIM card with unlimited data or Wi-Fi connectivity.

-

Battery Life:100 sales on a full charge

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:1.69% per in-person transaction for most major credit and debit cards

-

Warranty:12 months

-

Receipt Type:Digital

Payment Methods: Contactless, Chip and Pin

Connectivity: SIM & Wi-Fi

Warranty: 12 months

Receipt Type: Digital

-

Hardware Cost:£125 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.69%

-

Payout Settlement:1 day

- For businesses that need portable, robust and professional payments on the go.

- Ideal for a fixed location business like a shop, café or food truck.

- All-in-one device that combines a card reader, large touch screen, a full POS system and a receipt printer into a single, standalone unit.

-

Battery Life:100 sales on a full charge

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:1.69% per in-person transaction. Upgrade to Payments Plus for 0.99% transaction fee for £19 monthly cost. Rates for domestic consumer cards only.

-

Warranty:12 months

-

Receipt Type:Digital

Payment Methods: Contactless, Chip and Pin

Connectivity: SIM & Wi-Fi

Warranty: 12 months

Receipt Type: Digital

-

Hardware Cost:£249 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.69%

-

Payout Settlement:1 day

- Out-of-the-box solution designed for small to medium-sized businesses that want a professional, stationary till system without the complexity and cost of a full fledged POS

- 13″ touchscreen tablet with die cast aluminium stand, free pre-installed POS software and automated updates, a Solo card reader and charging station.

- Discount available on additional hardware such as printer or cash drawer

-

Battery Life:

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:1.69% per in-person transaction for most major credit and debit cards

-

Warranty:12 months

-

Receipt Type:Digital

Payment Methods: Contactless, Chip and Pin

Connectivity: SIM & Wi-Fi

Warranty: 12 months

Receipt Type: Digital

-

Hardware Cost:£29 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.10% + 7p

-

Payout Settlement:Instant

- Mobile businesses such as freelancers, market stall holders, taxi drivers or delivery services who need a reliable, on-the-go payment solution.

- Lightweight and compact card reader

- Standalone device – no smartphone needed

-

Battery Life:1 day

-

Payment Methods:Contactless, Chip and Pin

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:Rate for card sales up to £10k per month: 1.10% + 7p per transaction for UK and EEA consumer cards. AMEX 2.45% + 07p. All other Consumer & Commercial cards 2.85% + 07p

-

Warranty:1 year

-

Receipt Type:Digital

Payment Methods: Contactless, Chip and Pin

Connectivity: SIM & Wi-Fi

Warranty: 1 year

Receipt Type: Digital

-

Hardware Cost:£169 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.10% + 7p

-

Payout Settlement:Instant

- Smaller retail shops, salons or cafés that need the flexibility of a portable reader but also require the professionalism of issuing printed receipts at a fixed location.

- Mobile digital receipts or it can be placed in the dock to print a physical receipt. The dock also serves as a charging station which doubles the working hours of the terminal.

- Standalone device – no smartphone needed

-

Battery Life:1 day

-

Payment Methods:Contactless, Chip and Pin, Magstripe

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:Rate for card sales up to £10k per month: 1.10% + 7p per transaction for UK and EEA consumer cards. AMEX 2.45% + 07p. All other Consumer & Commercial cards 2.85% + 07p

-

Warranty:1 year

-

Receipt Type:Digital + Paper

Payment Methods: Contactless, Chip and Pin, Magstripe

Connectivity: SIM & Wi-Fi

Warranty: 1 year

Receipt Type: Digital + Paper

-

Hardware Cost:£229 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.10% + 7p

-

Payout Settlement:Instant

- All-in-one POS terminal designed for businesses that need speed, reliability and a enhanced user experience

- Powerful battery that lasts multiple days of active use and ultra-fast receipt printer to get you through orders quicker

- 6.5′′ HD Display

-

Battery Life:1 day (1500+ transactions on one charge)

-

Payment Methods:Contactless, Chip and Pin, Magstripe, QR payments

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:Rate for card sales up to £10k per month: 1.10% + 7p per transaction for UK and EEA consumer cards. AMEX 2.45% + 07p. All other Consumer & Commercial cards 2.85% + 07p

-

Warranty:1 year

-

Receipt Type:Digital + Paper

Payment Methods: Contactless, Chip and Pin, Magstripe, QR payments

Connectivity: SIM & Wi-Fi

Warranty: 1 year

Receipt Type: Digital + Paper

-

Hardware Cost:£199 + VAT

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.10% + 7p

-

Payout Settlement:Instant

- Businesses in harsh or outdoor environments like construction, repair services or food trucks as well as retail and hospitality businesses that need a powerful, durable and all-in-one terminal.

- Specifically designed to be robust, with a shockproof and water-resistant casing (IP54 certified).

- 60 Days Money-back guarantee

-

Battery Life:1 day (1500+ transactions on one charge)

-

Payment Methods:Contactless, Chip and Pin, Magstripe

-

Connectivity:SIM & Wi-Fi

-

Transaction Cost:Rate for card sales up to £10k per month: 1.10% + 7p per transaction for UK and EEA consumer cards. AMEX 2.45% + 07p. All other Consumer & Commercial cards 2.85% + 07p

-

Warranty:1 year

-

Receipt Type:Digital + Paper

Payment Methods: Contactless, Chip and Pin, Magstripe

Connectivity: SIM & Wi-Fi

Warranty: 1 year

Receipt Type: Digital + Paper

Alternative Payment Solutions

-

Hardware Cost:£0

-

Hardware Monthly Cost:£0

-

Transaction Fees:1.30% + 0.20 GBP (UK)

-

Payout Settlement:3-6 days

- Embed Airwallex’s Checkout solution into your website, boosting conversion potential with multiple payment methods and currencies – while saving on processing fees.

- Accepts 160+ local payment methods, including Apple Pay and Google Pay.

- Enables multi-currency processing without forced conversions.

- Integrates with platforms like Shopify and WooCommerce.

- Provides a conversion-optimised pre-built payment form.

-

Battery Life:N/A

-

Payment Methods:60+ local payment methods, including Apple Pay and Google Pay.

-

Connectivity:Online

-

Transaction Cost:1.30% + 0.20 GBP (UK), 2.40% + £0.20 for EEA cards; 3.15% + £0.20 for international cards.

-

Warranty:N/A

-

Receipt Type:Digital

Payment Methods: 60+ local payment methods, including Apple Pay and Google Pay.

Connectivity: Online

Warranty: N/A

Receipt Type: Digital

-

Hardware Cost:£0

-

Hardware Monthly Cost:£0

-

Transaction Fees:1% + 20p per transaction (capped at £4 for Standard plan)

-

Payout Settlement:2 days

- Great for recurring payments, subscriptions, invoices, and memberships businesses

- Collect 99% of one-off payments – and 97.3% of automated recurring payments using

- Provide a localised payment experience to customers in 38 countries.

- Built on bank payments instead of card payments which cuts transaction fees

- Reduces the need to chase late payments or update expired card details.

-

Battery Life:N?A

-

Payment Methods:Direct Debit (bank-to-bank)

-

Connectivity:Online

-

Transaction Cost:1% + 20p per transaction (capped at £4 for Standard plan)

-

Warranty:N?A

-

Receipt Type:Digital

Payment Methods: Direct Debit (bank-to-bank)

Connectivity: Online

Warranty: N?A

Receipt Type: Digital

We aim to keep all product information in our comparisons accurate and up to date, but details may have changed since publication. Always check before proceeding.

What to Look for in a Card Reader

For a small to medium sized business in the UK, choosing the right card reader is a choice that affects daily operations, customer experience and your bottom line. It’s no longer just about accepting plastic; it’s about finding a system that fits seamlessly with how you run your business. With card payments now a standard for most customers, having a reliable and efficient way to accept them is simply a necessity.

When you’re comparing options, look beyond the initial purchase price. The long-term costs often lie in the transaction fees, which can vary significantly between providers. Consider if the provider charges a flat percentage per transaction or a fixed fee and whether a monthly subscription is required. Think about how the device will connect to your network, too. A fixed, countertop reader might suit a retail shop with a permanent till, while a portable or mobile option could be more suitable for a café, a pop-up stall or a tradesperson on the go.

Ultimately, the best card reader for your business will depend on your specific needs. Are you a new business with an unpredictable sales volume? A flexible, no-contract option might be the best starting point. Are you a busy restaurant? A portable reader that connects to your existing point of sale (POS) system could streamline service. Don’t forget to consider how the system will grow with your business and whether the provider offers the support you might need.

How Card Readers Work

The process of a card payment may seem instant to the customer, but it’s a sophisticated journey involving multiple parties. When a customer taps, inserts or swipes their card, the card reader securely captures the payment information. This data is immediately encrypted to protect it from being intercepted and the encrypted data is then sent to a payment processor, who acts as the middleman between your business and the banks.

The processor sends the information to the customer’s bank for authorisation. The bank checks if the card is valid, if there are sufficient funds available and if there are any security flags on the account. A response is then sent back to the card reader to either approve or decline the transaction and this all happens in a matter of seconds.

Once approved, the funds aren’t immediately transferred to your account. They are held in a holding account until a ‘settlement’ period is complete. The timing of this settlement varies by provider, with some offering next business day payouts, while others may take several days. Understanding this timeline is important for managing your business’s cash flow.

Types of Card Readers for UK Businesses

The UK market offers a range of card reader types, each with unique features to suit different business environments.

Countertop Readers

These are the traditional, static card machines often seen at a single point of sale. They connect to the internet via an Ethernet cable or phone line, providing a consistent and stable connection. Their lack of mobility is offset by their reliability and robustness, making them suitable for businesses where all payments are processed from a single location such as a convenience store or a bakery.

Portable Readers

Portable readers operate via Wi-Fi or Bluetooth, allowing them to be carried around a business premises. They are an ideal choice for hospitality venues like restaurants and pubs, where staff can take the reader directly to the customer’s table. Their range is limited by the network signal, so they are suited for spaces that operate within a single building.

Mobile Readers

Mobile card readers are the most flexible solution. They connect to a cellular network via an integrated SIM card, meaning they can process payments almost anywhere with network coverage. This makes them a popular choice for mobile businesses like market traders, food trucks and tradespeople who need to take payments on location. Many of these devices are compact and can be paired with a smartphone or tablet, making them a cost effective option for smaller businesses.

Security for UK Businesses

Ensuring the security of customer payments is a non-negotiable part of running a business. All card readers and payment systems used in the UK are required to comply with specific industry standards to protect cardholder data.A key security measure is encryption, which transforms sensitive card details into unreadable code during a transaction. Another important layer of security is tokenisation, which replaces the actual card number with a randomly generated token for each transaction. These tokens are useless if intercepted by fraudsters, as they cannot be used to recreate the original card details. By using modern, compliant equipment, businesses can provide customers with a secure way to pay, building trust and protecting themselves from potential data breaches.

Card Reader FAQs

What are the main costs associated with a card reader?

The costs can generally be broken down into three areas: the initial cost of the device, the transaction fees applied to each sale and sometimes a recurring monthly fee. Some providers offer models with no monthly fees, which can be beneficial for businesses that have fewer transactions.

How do I know which card reader is right for my business?

The best way to choose is to assess your business’s needs. Consider your typical transaction volume, whether you need a portable or fixed solution, and if you need the card reader to integrate with other software, like accounting or stock management systems. The type of contract is also important, some are more flexible with no long term commitment, while others may offer lower transaction fees in exchange for a longer term agreement.

Can I use a card reader with my phone?

Yes, many modern mobile card readers are designed to pair with a smartphone or tablet via an app. This allows you to process payments using the physical reader while managing sales, products and receipts through your mobile device.

Is a card reader the same as a POS (Point of Sale) system?

A card reader is a component of a POS system. A card reader is specifically for accepting card payments, while a full POS system is a broader solution that includes other functions like creating invoices, tracking sales reports etc.

How long does it take for money from a transaction to reach my bank account?

The time it takes for funds to be settled and deposited into your business bank account can vary by provider. Some offer next business day payouts, while for others it might take a few working days. It’s an important factor to check as it can impact your business’s cash flow.